Ten days without luggage in Europe taught me a hard truth- even the best-planned trips can unravel. Having the right credit card with travel protections would have made all the difference.

We washed our underwear in the sink every day, and bought little more than toothbrushes and toothpaste. We finally bought swim suits at the gift shop- but that was it- because each day we were told our luggage would be ‘arriving tomorrow’.

Had my husband and I owned a credit card with travel insurance benefits, we would have been able to rest assured we would be getting compensated for some shopping, within reason of course. Instead, we wore the same outfits everyday for 6 days until we were told our bags were ultimately lost.

In a Nutshell

- Premium travel credit cards include benefits like trip cancellation, delay coverage, and lost baggage insurance.

- Understanding the specifics and limitations of travel protections from credit cards is crucial for travelers.

- Some credit cards even extend travel protections to authorized users, enhancing their value.

- Choosing the best credit card for travel protection depends on individual needs and situations.

The Travel Insurance Already in Your Wallet

Travel protections that come included with many premium travel credit cards give peace of mind and the confidence to book travel, even in times of uncertainty. For anxious travelers like myself, the inclusion of travel insurance alone now legitimizes high annual fees that at one time I would have scoffed at.

Even one extra night of lodging and a few additional meals tacked onto a trip can stretch or even break the budget of many travelers- the right credit card and included travel protections can cover those added expenses.

Before getting credit cards that offered travel protection, I was regularly spending hundreds of dollars per trip, fearing unforeseen mishaps that might delay or cancel a vacation. During Covid, I became acutely aware of the vulnerability of losing sums already paid for lodging, tours, and other prepaid expenses.

In this guide, we’ll explore what credit card travel insurance includes, what it doesn’t, and how to decide whether you still need extra coverage.

How does travel insurance from credit cards work?

While each credit card and its travel protections work differently, there are some basic requirements in order for claims to be eligible for coverage:

-The trip must be purchased on the credit card with travel protections

-Receipts and proper documentation will be required to file claims

-Only eligible travelers will be covered by the benefits

-Claims will be filed directly through the credit card’s travel insurance system

-Reimbursements through the credit card will kick in only after all other options have been exhausted (coverage provided by airlines, purchased travel insurance, etc.)

What travel protections are included with premium credit cards?

While travel insurance benefits differ between credit cards, the majority of them include the following features:

- Trip Cancellation & Interruption Insurance — Reimburses nonrefundable expenses for covered reasons.

- Trip Delay Coverage — Covers meals, hotels, and transportation after a set delay.

- Lost or Delayed Baggage Insurance — Pays for essentials and reimburses for lost items.

- Travel Accident & Emergency Medical Coverage — Reimbursements for treatment in case of injury or illness abroad.

- Rental Car Damage Protection — Covers collision damage without using your own auto insurance.(Usually will not work when renting cars internationally)

- 24/7 Travel Assistance & Concierge Services — Access to emergency help and travel support.

Additional travel insurance included for some credit cards include the following:

-Coverage and Reimbursement for Medical and Dental Emergencies

-Emergency Evacuation Transportation- Immediate transport to the nearest location where your medical needs can be met

-Repatriation of Remains- In the event of death, transportation of the body back to the country of residence

Credit Card Travel Protections Vary- Get to Know the Benefits

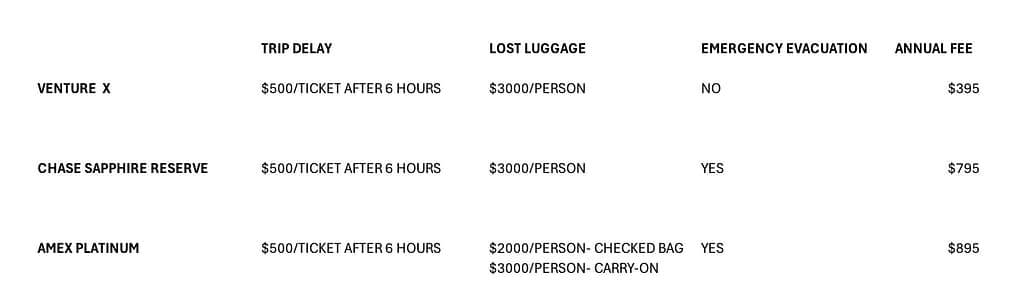

It is important to get familiar with the specifics of the benefits included in the travel protections offered in a credit card. Even the benefits commonly included like trip delay and baggage delay/loss vary between credit cards, like number of hours of delay needed to trigger a benefit, reimbursement caps for lost luggage, or the payout amount per day for delayed baggage.

The Chase Sapphire credit cards are a perfect example. For trip interruption insurance when a common carrier is delayed, Chase Sapphire Reserve customers are eligible for reimbursement after only 6 hours of delay, while Preferred customers require a 12 hour delay to be eligible for a payout. Additionally, Chase Sapphire Reserve clients have Emergency Evacuation transportation included in the benefits, while Preferred clients do not.

It’s critical to understand the details of your included benefits as coverage hinges on proper access. For example, for Emergency Evacuation needs you must contact the benefit administrator to arrange transport. Arranging transport through other methods will not qualify for the coverage.

Read your Benefits Guide carefully. If you are covered by multiple credit cards, get to know the differences in benefits and book travel accordingly.

Know the Limitations of Credit Card Travel Insurance

While having travel protections included in a credit card is a worthwhile perk, it is not comprehensive coverage and the limitations of the benefits should be understood. There are various situations where coverage will not apply, so familiarize yourself with the specifics of your benefits.

Some restrictions are but not limited to the following:

-Your reason for trip cancellation are outside of eligible causes listed in the policy (changed your mind, needing to cancel due to illegal acts (imprisonment), etc.)

-Pre-existing medical conditions

-Complications experienced during medical travel

-High-risk activities (Bungee jumping, skydiving, etc.)

-Traveling in a war zone

-Trip is not further than 100 miles from home

-Trip is too long for coverage (most cover up to 60 days only)

Who Is Covered By Travel Protections Through a Credit Card?

Credit cards vary regarding who the travel protections will include, but outside of the primary cardholder the benefits may extend to a spouse, children if traveling together, and sometimes other non-familial travel companions.

Review your Benefits Guide for specific details included in the policy.

Authorized Users Get Credit Card Travel Protections Benefit Too

One of the most exciting features of premium credit cards that offer travel protections is that some of the benefits extend to their authorized users. What’s more, some credit cards with travel insurance like the Venture X and Atmos Rewards Summit allow free authorized users on the account. Venture X allows up to 4 authorized users, and currently the Atmos Rewards cards do not have a designated number of maximum authorized users listed.

While the travel benefits like TSA Precheck/Global Entry credit don’t roll over beyond the primary cardholder, having authorized users who also get to benefit from the travel protections free of charge is an incredible perk, making the annual fees ($395 for each of the Venture X and Atmos) worth the price. Other programs like the Chase Sapphire family and American Express charge $195 per authorized user.

How to File a Claim for Credit Card Travel Insurance

While some coverage will require contact to the benefits administrator prior to getting care, such as for Emergency Evacuations, most other claims will be filed after the need. Many benefit administrators will have 24-hour hotlines for emergency services. Otherwise, file your claims as soon as possible through the insurance portal of the benefit administrator- there will be a window of time within which a claim must be filed, generally 30-60 days.

The reimbursement process can be lengthy, taking 2-6 weeks or longer in some cases. Make sure to check your email regularly or log into the portal as there may be frequent requests for more documentation.

Do I need to Purchase Separate Travel Insurance if My Credit Card Has Travel Protections Included?

Every person and every trip is different. While some travelers would never travel internationally without purchasing additional coverage, plenty of people have gone their entire lives never having had any kind of travel protections on their trips.

If your main concerns are making sure you’ll get reimbursed for incurred expenses due to delays or cancellations, you’ll likely have your needs met with the travel protections included in your credit card.

Credit card travel protections were never intended as comprehensive health coverage, so purchasing additional coverage through a third party is a great way to get peace of mind. Particularly with medical coverage, international travel is a smart time to purchase additional coverage as most American healthcare plans do not offer coverage outside the US- some have limited use in Canada and Mexico, depending on the plan.

There are many competitive plans for third party travel insurance, with varying premiums and levels of coverage depending on trip factors like length of trip, amount already spent, amount expected to spend in entirety and levels of coverage desired.

I personally have purchased plans in the past through Tin Leg and Squaremouth, but luckily did not need to use them during my travels. I found their websites easy to navigate and I was pleased with my options for coverage.

Third party insurance plans will cover the basics like trip delay/interruption and baggage loss and delay, but will have more robust medical options depending on your needs. The Points Guy has a great review of travel insurance plans, as well as a few more overviews from Forbes and NerdWallet.

Which is the best Credit Card for travel protections?

The most notable and widely-recognized credit cards that offer travel protections include Capital One’s Venture X, Chase Sapphire Preferred and Reserve, and the American Express Platinum. Upgraded Points has an overview of the travel protections these cards offer.

Atmos Rewards, the resulting loyalty program from the Alaska and Hawaiian Airlines merger just released the Atmos Summit Visa Infinite credit card. It is the first credit card released by Bank of America in the Alaska (now Atmos) mileage program to offer travel protections included in its benefits.

Other airline and hotel branded credit cards also include travel protections, including a variety of Citi Strata cards, Hilton Honors Aspire, Marriott Bonvoy, and United Quest. Forbes does a great review of co-branded cards with travel protections here.

Final Thoughts

Travel insurance credit card benefits have come a long way and offer travelers robust protections for myriad scenarios. There is no single ‘best card for travel protections’ because every individual has different needs. But with low annual fee cards like the Chase Sapphire Preferred and the Ink Business Preferred (both $95 annually), many people now have access to travel protections through credit cards that they may not have had previously. Bilt Mastercard, which has no annual fee, even offers very basic travel protections included in their benefits.

With fewer passenger protections and more unpredictable weather than ever, having built-in travel insurance from your credit card is one of the easiest ways to travel with confidence. While there are refund polices in place for cancelled flights for some specific scenarios, having built-in travel protections means you can relax and focus on enjoying your trip instead of worrying about what might go wrong.